Reliability

Drives

Trust

We know how hard it is to grow a business without a trusted co-pilot — that’s why we make reliability our core product.

VTV Corporate Services was built on one core belief — reliability drives trust. Our clients trust us because we leave no room for chance when we take the financial and compliance burden off public company CEOs. Founded by two active executives and board members of public companies, Ivan Riabov, CA, CPA, a former PwC senior manager and Manulife director, and Vitaliy Savitsky, a former CG equity research analyst and entrepreneur, we combine big-league experience with startup agility.

The Backbone of Your Public Company

We deliver turnkey financial, governance, and compliance solutions that let public company leaders focus on growth, not paperwork. Our track record speaks for itself — disciplined execution, transparent systems, and results that restore confidence, drive efficiency, and create lasting value.

Finance Team

We handle the financial backbone of your public company so you can focus on building it. From Bookkeeping, Payroll and Taxation to Cash and Payments Management, we ensure every transaction is accurate, verified and audit-ready. Our internally built reporting system streamlines the flow of data into clear, actionable management reports — giving Executives instant visibility and control while preparing for audit from day one.

Outsourced CFO

We oversee the corporate governance and financial planning to build confidence in the boardroom and the market. From mandatory Quarterly FS + MD&A, to annual Audit, and from BOD Deliberations to Budgeting and Cash Flow + Debt management. For more active issuers, our services include detailed Financial Modelling, Cross Listings, Private Placements, Corporate Transactions, Investor and Sell Side relationships development.

Corporate Secretary

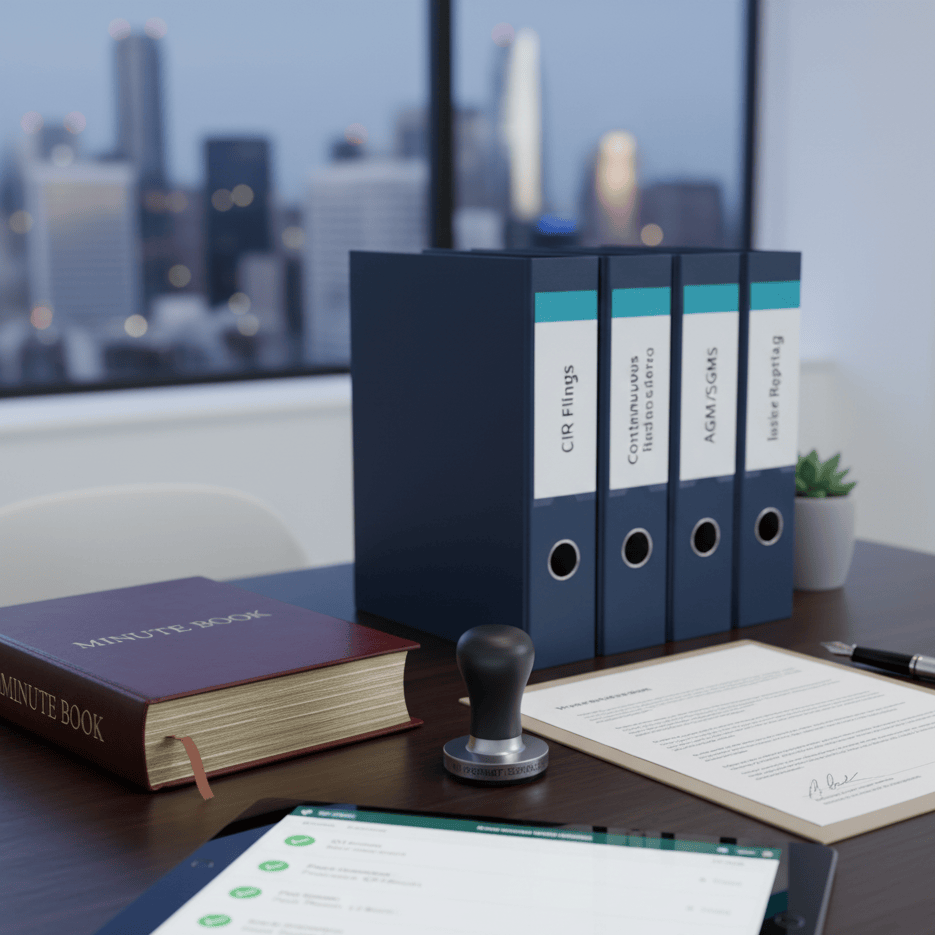

We manage all CIRO and Securities Regulator Filings and continuous disclosure requirements, including the full Press Release cycle, AGMs/SGMs, insider trading and reporting, and minute book maintenance. We’re flexible — ready to work seamlessly with your existing auditors, legal counsel, and IR firms, or to build a tailored vendor stack from the ground up.

Track Record

From CTO to $10M+ in financing, $30M+ in sales: we specialize in rebuilding value through disciplined execution.

When we were brought in, American Aires was facing a cease-trade order and on the verge of bankruptcy. We rebuilt the company’s financial foundation from the ground up — overhauling accounting systems, implementing disciplined reporting processes, and restructuring its audit and legal relationships. Our team worked directly with regulators to lift the CTO and restore full compliance, ensuring every subsequent filing was completed accurately and on time. With reliable systems and transparent monthly reporting in place, Executive team gained the visibility needed to anticipate challenges and make confident strategic decisions. In parallel, we proactively reached out to investment banks and led a coordinated investor relations campaign to build awareness and strengthen the company’s capital-markets presence. As a result, the company improved its performance, growing sales from $2 million to over $30 million, and rebuilt investor trust — raising more than $10 million in new capital through a clear narrative and sustained engagement.

Our team

Our team blends institutional-grade financial expertise with entrepreneurial execution. Led by founders Ivan Riabov and Vitaliy Savitsky, both active executives and board members of public companies, who bring multidecade big-league experience, and combine the mindset of top-tier finance with the agility of a modern, results-driven partner.

Ivan Riabov, CPA, CA

Co-Founder, Accounting

Mr. Riabov serves as Director on boards of several public companies and is a seasoned finance and accounting professional with over 17 years of experience in public accounting, audit, investment management, operations, product structuring, and debt financing. He earned his BBA from the Schulich School of Business and holds both the Chartered Professional Accountant and Chartered Accountant designations. Throughout his career, he has held several senior positions at PricewaterhouseCoopers, Manulife Investment Management, Timbercreek Capital. His ability to turn complex financial challenges into disciplined, measurable results gives him a unique depth of expertise across capital markets and corporate operations.

Vitaliy Savitsky

Co-Founder, Capital Markets

Mr Savitsky currently and serves as Director and Executive of several public companies and is an iBBA graduate from Schulich School of Business with over 15 years of experience in capital markets and business development. His career began in 2008 in institutional equity research at Canaccord Genuity before expanding into leadership roles across fintech and growth-stage ventures. At Soundpays, he built and led the business development team, forging partnerships with global leaders including JP Morgan Chase, Visa, Mastercard, Amazon, and eBay. A hands-on entrepreneur, Mr. Savitsky also founded and successfully exited Comfort.to, a Toronto-based Costco delivery platform — experience that gives him a rare blend of capital-markets insight and operational execution.

Need a trusted co-pilot for your public company journey?

Every great partnership starts with a conversation. Tell us about your company, your goals, or the challenges you’re facing — and we’ll show you how our team can bring in structure, clarity, and confidence.

Contact us

Have a quick question or looking for a career change? Let’s get connected and see what we can do together.

Services

Financial Operations & Reporting

We handle the financial backbone of your public company so you can focus on building it. From bookkeeping, payroll, and taxation to cash and payments management, every transaction is verified, accurate, and audit-ready. Our proprietary reporting system turns data into clear, actionable management reports — giving executives instant visibility and control.

Strategic Finance & CFO Services

We act as your outsourced CFO, overseeing financial planning, governance, and capital structure. From quarterly financials and MD&A to annual audits, budgeting, and cash flow management, we ensure precision and compliance across every level of reporting. Our hands-on approach gives boards and executives the clarity to make confident, data-backed decisions.

Corporate Governance & Regulatory Compliance

We manage all securities filings, CIRO requirements, and continuous disclosure obligations, ensuring your company stays fully compliant and audit-ready. From press releases and AGMs to insider reporting and minute book maintenance, we handle every procedural detail with accuracy and consistency. Our goal is simple — no surprises, no delays, no regulatory friction.

Capital Markets & Transactions

We support the full range of capital markets activity — from private placements and warrants to debt offerings, M&A, and cross-listings. Our team liaises with legal counsel, auditors, bankers, and regulators to execute complex transactions seamlessly and in full compliance with securities laws. Every engagement is guided by structured execution and a deep understanding of market expectations.

Investor Relations & Market Positioning

We build and execute investor relations strategies that drive awareness, engagement, and long-term trust. From investor story development and roadshows to digital campaigns and research-style reports, we manage the full communications cycle to keep your story visible and compelling. Our coordinated approach connects management, brokers, and investors to strengthen liquidity and valuation.

Turnarounds, CTOs & Special Situations

We thrive in complex scenarios — from cease-trade-orders or crisis management to full-scale financial turnarounds. Our track record includes guiding public companies from regulatory suspension back to growth and profitability through disciplined systems, transparent reporting, and proactive capital-markets engagement. When reliability is most critical, we bring the structure, credibility, and execution to restore confidence.